To order property of one’s own is a dream for the majority of individuals. But the large price of possessions often means it can easily simply take very long and most preserving having a house. To save money, of many possible buyers plan to find a house that requires particular TLC. However, bringing a mortgage to possess a fixer-upper has many subtleties to keep in mind.

Protecting home financing for a fixer-top is a great method of getting for the a property that you really can afford. To order a property that requires a tiny attention is even the finest cure for make household uniquely your own because you carry out condition, updates, and you may home improvements.

For financial needs, the fresh new professional class in the TwinCity Credit will be here to greatly help. The concierge solution ensures you earn an educated pricing, provider, and you may closing process.

Why Prefer A good Fixer-Higher?

- Less Rates When you yourself have your heart set on a certain location, nevertheless the prices are from the assortment, following an excellent fixer-top may be the prime service. Using their shorter-than-best condition, they frequently hold cost less than business speed. The low price means they are an excellent solution. You might find your self residing your ideal place for good tiny fraction of your own costs.

- A mature House In general, fixer-uppers become elderly services. This can be perfect if you are looking for a gap that is actually bursting having character and you may totally new facts. Unlike developing a home that looks like all of its neighbors, you could restore the period has particularly window, cornices, and you will extremely-higher ceilings. It is fun to take attraction and majesty to a great faded beauty.

- A chance to Allow it to be Their One of the tall is attractive of a fixer-higher ‘s the opportunity to place your spin toward property, and work out they feel like your property. So it opportunity is very pleasing if you are intending to keep into the overall. You might build your ideal dream household from new beginning.

What are The options?

Whenever determining the way to get a mortgage to own good fixer-higher, of numerous people opt for a renovation financing. Such mortgage plan is beneficial when you need to pick a house that requires certain works. It permits one to money the purchase of the property, and the crucial advancements required into one to financing. You merely get one monthly payment to cover financial and you can home improvements.

It smooth financial package is a great method of getting come into the homeownership without a significant outlay of money. A few of the most prominent repair financing solutions include:

- FHA 203(k): This choice appear from the Federal Houses Relationship which is available to the people that have a lower life expectancy income and credit score. The newest FHA 204(k) is appropriate for almost all do-it-yourself plans. You need to use money to control each other architectural and you will beauty products home improvements. In addition to this, really works will start whenever you romantic.

It’s important to remember that these fund are only appropriate having no. 1 houses. You would not manage to sign up for home improvements into the accommodations assets otherwise 2nd household. There are even limits on which you can do toward funds. Privileges eg a swimming pool otherwise high surroundings do not be considered for using the mortgage currency.

There are 2 type of 203(k) loans: limited and basic. The newest limited variation is available to use for one home improvements up so you can $thirty five,100, should they don’t need biggest structural functions.

The product quality choice discusses methods that have budgets over $25,100000 otherwise where extreme structural improvements are crucial. For this channel, you should run an excellent HUD agent. They enhance the resident analyze estimates and you may manage the checks.

- Virtual assistant Repair mortgage: The money supplied by the fresh new Agency out of Veterans Things had a recent up-date. Now he’s qualified to receive include in the acquisition and you may renovation away from a home. Keep in mind that because of it type of loan, you want a beneficial Va-approved contractor, and there is a construction payment connected to the mortgage.

- Fannie mae HomeStyle: A good HomeStyle loan need a higher credit rating compared to FHA 203(k) money. However, whatever home improvement is eligible, and additionally landscape if not creating a share. With Fannie mae support, this mortgage is a famous choices if you’re planning a complete deluxe overhaul of a home.

- CHOICERenovation Loan: Secured because of the Freddie Mac computer, this package carries plenty of positives. It is perfect for the individuals trying to a lower life expectancy-costs the home of purchase whilst enjoys a minimal off-payment criteria. Consumers might even secure a down-payment by simply making solutions themselves before closing.

A remodelling loan is a perfect way to be sure to can meet your financial obligations whenever you are nonetheless concentrating on developing and you may strengthening your ideal family.

How can i Begin a mortgage to have a great Fixer-Upper?

If you opt to head off so it station, step one will be to talk to your lender. It is best to work with a large financial company rather than that loan manager who works together one organization. The fresh broker will be able to offer so much more alternatives for your capital means. They will walk you through the options that assist your influence a knowledgeable mortgage to your requirements.

Once you have a strategy together with your financial, it is time to wade house search. Be sure you enjoys an experienced realtor that will make it easier to through this processes. And if you do not plan to perform the functions your self, it’s a good idea to have a builder available to render you some advice and you can enter in too.

If you find yourself inside offer to the a house, you will probably need certainly to obtain prices towards strive to be done. Possibly this information is needed seriously to close the transaction.

TwinCity for the Financing Means

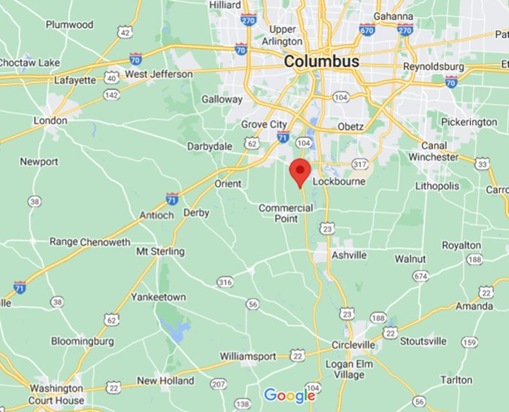

Long lasting stage from real estate you are in, the latest amicable employees at TwinCity Lending is here for you. We are able to make it installment loan agency Columbus NC easier to browse FHA and you can Virtual assistant funds, together with household collateral and you may jumbo mortgage packages. Touch base today to start off.

Leave a Comment