Whether or not loan providers always favor high credit-score whenever offering an effective HELOC, a reduced rating doesn’t necessarily disqualify you. There are household security loan providers you to approve an excellent HELOC which have bad credit. These lenders believe additional factors, such a minimal personal debt-to-earnings ratio and most essential a low financing-to-really worth ratio. If you’re looking to have a less than perfect credit HELOC you should has at least 25% guarantee in your home.(less than 75% CLTV)

Should i get a keen FHA home guarantee mortgage having less than perfect credit?

FHA does not ensure FHA household equity loans for example they are doing get or refinance mortgage loans. It make it security lenders or HELOCs at the rear of an FHA insured mortgage, nevertheless they do not promote them from the Federal Housing Management. They do provide the FHA 203K to own home home improvements, however the rules are more strict than antique home guarantee mortgage circumstances.

What can prevent you from being qualified to possess a property security financing?

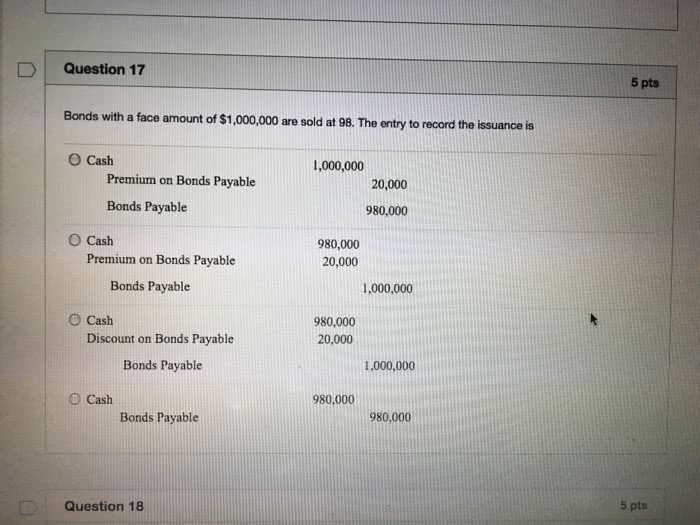

Besides borrowing from the bank, the new combined mortgage to help you well worth is a vital grounds in order to qualify for a collateral mortgage or HELOC into the 2024. Most lenders require that you preserve at the very least 15% in order to 20% 80 in order to 85% LTV) equity of your property shortly after bookkeeping toward new home guarantee amount borrowed that’s in the event that you9 has good credit-results. When you have poor credit-ratings, then you could need 20 to thirty five% guarantee of your house otherwise (65 so you can 80% LTV) In the event your house’s worth hasn’t increased sufficiently or you have not paid off off enough of your financial, you happen to be ineligible getting a 2nd mortgage or distinctive line of borrowing due to lack of equity.

Can i play with a home guarantee financing getting debt consolidation reduction?

Yes. Of numerous individuals pull out a house security loan to repay high attract personal debt, handmade cards, and you can varying rate household equity credit lines. Merging obligations that have a predetermined speed home guarantee mortgage can aid in reducing the monthly personal debt costs and supply enhanced savings that replace your financial situation.

Do mortgage brokers provide secured home equity financing having bad credit no credit check?

No. Loan providers dont ensure domestic collateral fund versus credit assessment of comparing an effective property’s worthy of. Because this is an additional lien on domestic, the risk grounds develops significantly. The home equity financing can’t be secured no credit score assessment like a tiny cash advance otherwise consumer loan that’s unsecured.

Because of the consolidating highest-attract expense with the you to definitely, less expensive family equity loan, consumers can notably improve their economic situation by detatching their monthly burdens off higher notice credit card and you will higher level unsecured loans.

Credit rating Variables: The primary grounds influencing approval to own a property security financing was your credit score. While old-fashioned lenders normally prefer a score significantly more than 700, you’ll find loan providers willing to imagine candidates that have less borrowing get.

It’s advisable to find guidance off monetary advantages so you can browse brand new complexities regarding guaranteed household collateral fund which have bad credit effortlessly. Unless you meet up with the home equity financing criteria since away from lowest credit ratings or money records, envision hard money loans having reduced credit scores.

Very bad credit contours features a varying rate of interest that have a great quick repaired-price months at first. Following the mark age of five otherwise 10 years closes, the rate can move up or down.

We ignore the great things about paying off their bad credit HELOC as they don’ read the good perception it can possess to your your own credit reports. If you are paying the HELOC per month regularly try compensated of the Experian, EquiFax and you may Trans Connection. personal loans online Indiana These borrowing from the bank repositories certainly enjoy borrowers paying the HELOC payments whenever he or she is owed.

Leave a Comment