Before you could personally guarantee home financing or other loan to possess an effective relative, and for your own firm otherwise LLC, you should be sure you are sure that the mortgage guarantee contract.

Providing a family member otherwise good friend get home financing otherwise most other mortgage, or bringing a loan on your own company, may require you to directly guarantee the financing.

Spends out-of Mortgage Make certain Plans

So it most frequently happen between members of the family, where in fact the borrower can’t see a loan because of a shortage of cash otherwise advance payment, otherwise due to a dismal credit get. A guarantor including enables you to safer a far greater desire speed or other so much more favorable financing terminology.

Popular instances is actually whenever moms and dads make sure a mortgage thus a kid can buy a home, otherwise be certain that a loan for a motor vehicle get. Financing make sure plus can help assist someone out out of a financial bind. If someone is within standard into the an existing loans installment loan Nashville, and could become facing collection procedures, it can be you can easily so you can upgrade the brand new terms of the borrowed funds, otherwise receive another loan, by offering financing make certain.

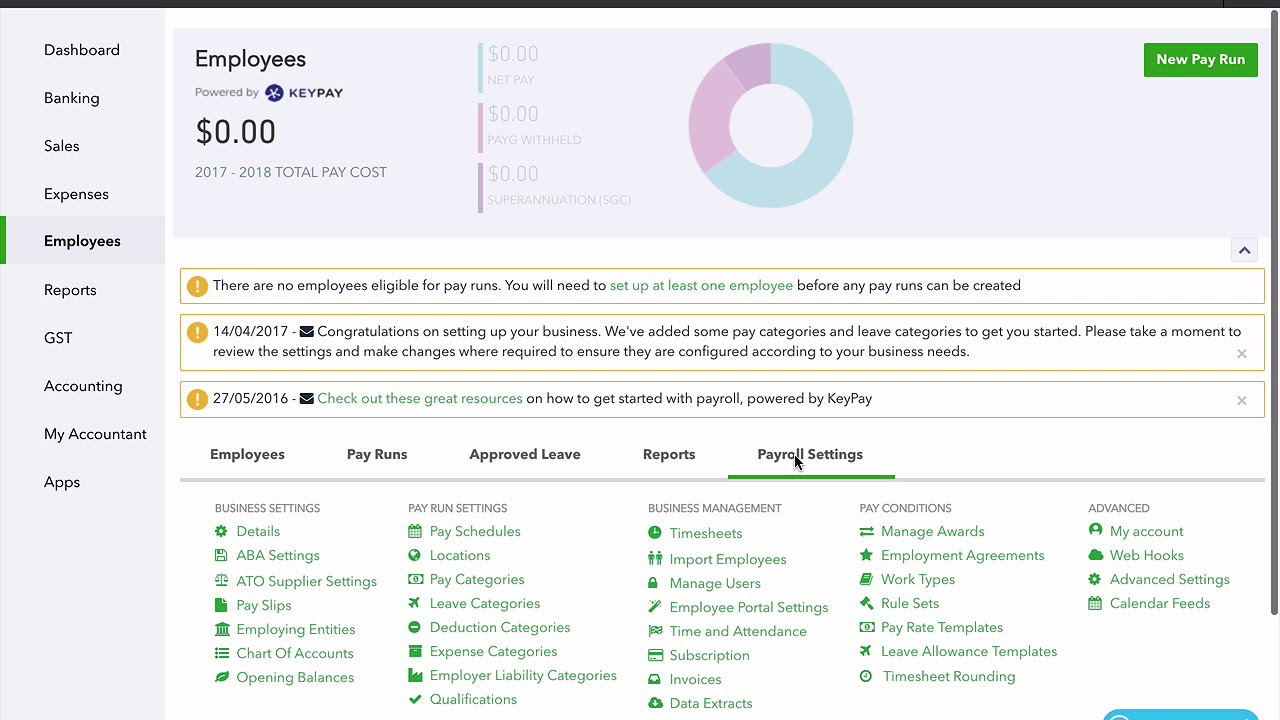

Several other access to that loan make certain try borrowing from the bank money first off otherwise grow a corporate. You have prepared your business once the a company otherwise minimal responsibility business (LLC) to enjoy the restricted individual responsibility they has the benefit of. Should your company has no sufficient assets to have equity, lenders get imagine a loan towards the business organization as well high-risk. In this case, you might have to sign that loan arrangement with your own make certain. Because guarantor, you are negating the personal accountability defense of your own company or LLC about what financing, and so are enabling the lender to go immediately after your very own possessions if there is default.

Being the Guarantor

Is new guarantor for a loan try one step that ought to not drawn lightly. Even when the borrower maintains money, the guarantor is generally prohibited out-of mobile possessions otherwise providing almost every other financial strategies without the consent of financial.

Really serious consequences can occur in the event your borrower non-payments. Not only is it needed to step up and come up with the latest payments, you ounts from inside the standard, in order to pay lawyer charges or any other range will set you back. In addition, it can have an adverse effect on your credit rating. This new borrower’s standard plus make the complete equilibrium of the financing owed quickly, in the place of its getting paid down in amazing terms.

Posts of that loan Make sure Agreement

The loan ensure agreement constantly was created by the financial institution. Its right words are different depending on the lender, and you can upon county rules. Most, if not completely, of your regards to the brand new arrangement might possibly be designed to include the financial institution.

The new contract can create a total otherwise unconditional guarantee, and this obligates the fresh new guarantor to your loans if the debtor defaults for any reason. Otherwise, brand new arrangement is obligate this new guarantor on condition that certain mentioned criteria are present. Instance, it might need the bank so you’re able to basic realize most of the legal collection remedies contrary to the debtor ahead of embracing the brand new guarantor to own percentage.

This new ensure together with ple, if for example the loan was secured since the debtor has no the latest 10% down payment that is normally necessary, the latest guarantor may only enjoys liability for the ten percent. The fresh new contract in addition to might provide on the discharge of the newest guarantor’s responsibility shortly after a lot of security could have been reached.

And the type of terms included in whatever deal, there are specifications that will be unique so you can loan make sure plans, such as for example:

- Warranty off payment and never from collection. A statement to that impression allows the lender to visit immediately following the newest guarantor instantly on default from the borrower, without the need to earliest look for collection on debtor.

- Accountability having lawyer fees or other will set you back out of collection contrary to the debtor. That it goes beyond putting some guarantor accountable for will set you back out of getting collection in the guarantor.

- Waiving directly to observe away from default. Regardless of if you might genuinely believe that an obligation of lender would be to getting to help you promptly notify the new guarantor in case there is standard by the debtor, the mortgage verify plans of lenders especially avoid that it.

- Consent to amendment of your financing. When your bank and debtor after modify the regards to brand new mortgage, it may alleviate the guarantor off accountability. It depends through to condition law, and if the amendment significantly boosts the guarantor’s chance. The financial institution may require the guarantor so you can indication a unique guarantee agreement. To quit it, the initial agreement offer the guarantor consents to be bound by one improvement.

Whether the individual be sure financing contract need to be seen or notarized might possibly be dependent on this new lender’s conditions, and possibly of the state rules. If your mortgage talks about a home, new arrangement might must be observed and you will notarized in the same manner as needed for a deed.

The main thing having an excellent guarantor to see and you may comprehend the loan ensure arrangement. To own assistance with planning a loan be certain that arrangement, you’ll be able to consult with legal counsel, to make sure that you will be properly protected on your part while the guarantor of your own financing.

Leave a Comment