- 30 yr Fixed 30yr Fixed

- 15 year Fixed 15yr Fixed

- 5/step 1 Sleeve 5/1ARM

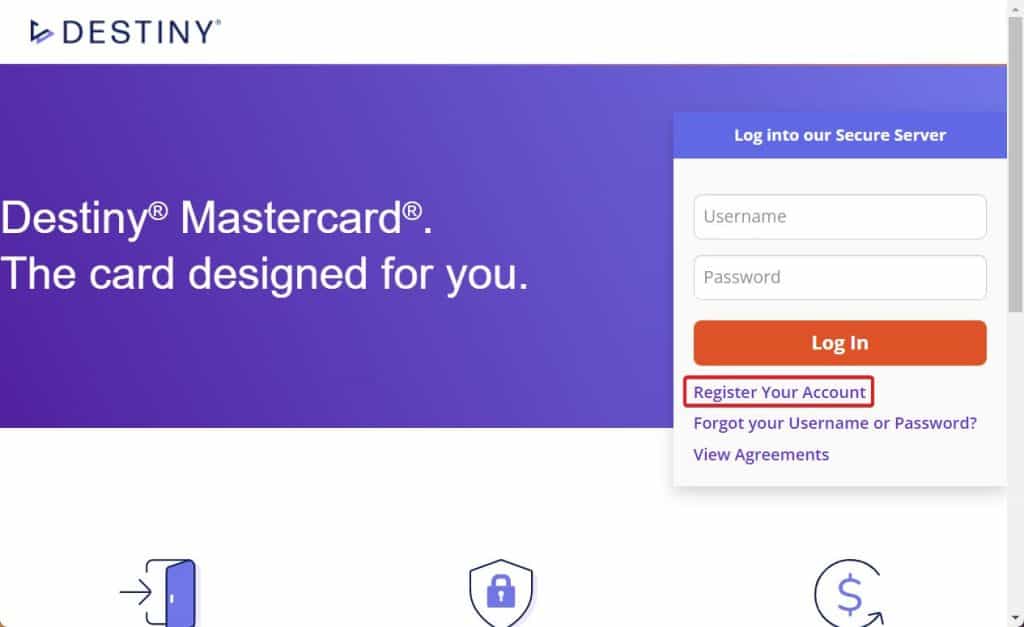

Ally Financial operates completely on the web, which have an easy-to-navigate webpages. You can easily comprehend the prices and mortgage terminology readily available. You’ll be able to get in touch with a customer support representative to determine more about the items and you may terms before committing. As you prepare, it’s easy since clicking a button to get the techniques started. Once you have a merchant account which have Friend Financial, you can access that and one future Friend banking account online also. But if Friend Bank is servicing your own mortgage, that’s done as a result of Cenlar, maybe not Ally. So you would need log on to Cenlar to get into your own home loan membership.

Would you Qualify for a mortgage Of Ally?

Your credit rating is important with respect to a home loan just like the bank will want to see your reputation of purchasing toward borrowing from the bank and you can paying fund. You will need a credit history of at least 620 to be sensed to own an ally home loan. The get will also help dictate the financial interest rate. Generally, for those who have increased score, you can snag a far more positive interest. You should and make sure you have no hugely bad information on your credit score. When you submit an application for fund eg a mortgage, the financial institution could make a difficult query into the credit file. For those who have things like bankruptcy proceeding otherwise costs-offs in your declaration, your odds of home loan qualification tend to disappear significantly.

The debt-to-income proportion investigates the overall monthly expenditures given that a share of the gross month-to-month money. This will make sure you do not are obligated to pay even more than you could potentially pay-off. Your work background and you will stability takes on to your so it factor, also. When you find yourself usually moving from employment to jobs, a lender may see what you can do to settle the mortgage because unsound.

Friend will take a look at how much you could lead due to the fact your down payment. As a rule out of thumb, the right deposit might be 20% of the house speed. Although not, this is not possible for group nor is it required. Whenever you set increased count off, you will see a much better interest rate, a high acceptance rates and you may shorter monthly obligations.

Ally begins the borrowed funds process from the pre-qualifying people. This is done into Friend Family Team exactly who deals with you to definitely see your situation, pointers and you may desires. This will determine which mortgage possibilities is the good for you and then next needed procedures. To help make the processes sometime much easier, Friend Lender has no need for data files or charges locate pre-entitled to an interest rate.

Whenever you are a first-go out homebuyer, Ally also offers usage of Fannie Mae’s HomeReady home loan system. This option try geared to basic-date homebuyers and also for people that may possibly not be capable make a big deposit. Homeowners whom qualify for this option can pick anywhere between a twenty-five- or 29-seasons repaired-rate title. If you had been concerned that Friend may not accept their application while the a primary-time homeowner, you are in luck.

What’s the Process for finding a home loan Having Friend?

The first step into delivering home financing with Ally Financial is taking pre-licensed. To begin with this process, you could label your house Mortgage agency on step 1-855-256-2559 and you may consult with a home loan Coach. You can even fill in an on-line form having an enthusiastic mentor call you alternatively. The house Mortgage Mentor is the basic person of your Friend Domestic Class you are going to speak with. Since you move also the family-to find process, possible focus on a loan planner and you may a closing planner, also. Your residence Mortgage Coach ‘s the person that will need good look at your advice and help you decide which device, or no, would-be effectively for you. This consists of and work out one to hard simplycashadvance.net/3000-dollar-payday-loan query into your borrowing from the bank, if you approve the fresh inquiry.

Leave a Comment