This will be greater than the attention prices toward other kinds of government figuratively speaking, and that already range between 5

- you need to be this new biological otherwise adoptive parent of an established student student,

- the fresh college student need to be enlisted about half of-time in a qualifying facilities, and you may

- you should not has a detrimental credit history.

You and your man must also fulfill general federal scholar support conditions, such as for instance being a great U.S. resident otherwise long lasting citizen and you may doing this new 100 % free App to have Federal Student Support (FAFSA).

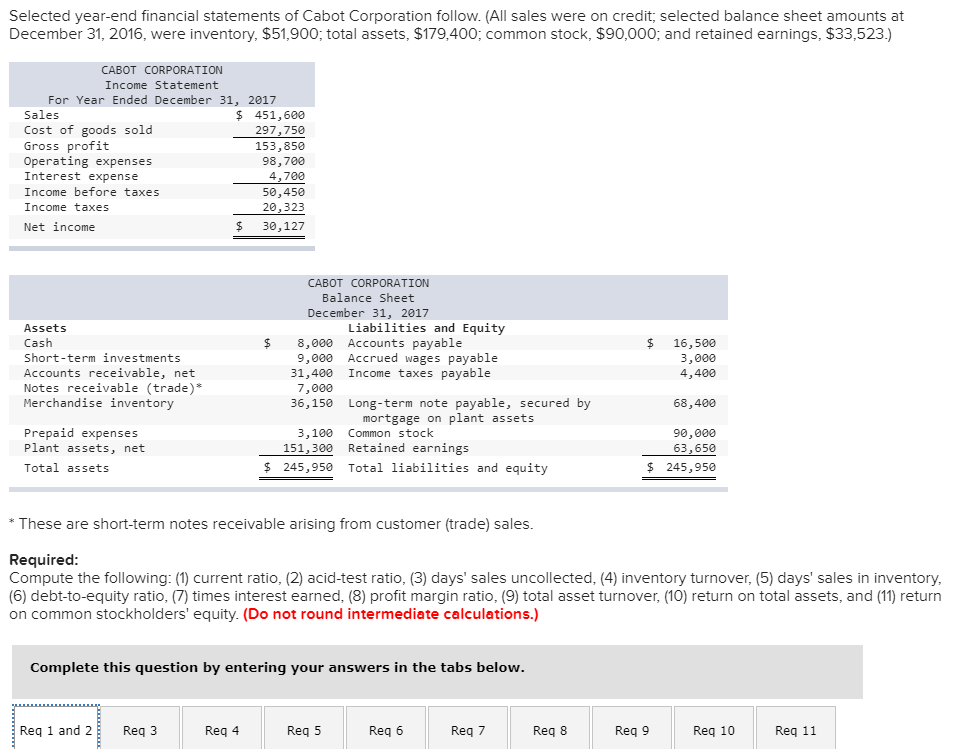

Federal student loan terminology are identical each borrower. Father or mother Head Together with financing awarded in advance of , have an interest speed of eight.6%. The interest rate is restricted with the longevity of the mortgage. 05% to own Head student loans in order to six.6% for graduate Lead And fund. You could use around a full cost of attendance at the your son or daughter’s university, without virtually any financial help your child gets.

Father or mother Lead And finance give a lot more flexible installment terms and conditions than simply private figuratively speaking, but less than Direct fund for college students. You can choose from the following possibilities:

That is more than the interest pricing into the other kinds of federal figuratively speaking, and this currently range from 5

- Simple repayment bundle: You have to pay a predetermined monthly count per month getting 10 years.

This can be greater than the interest cost on the other kinds of government figuratively speaking, and that currently may include 5

- Finished payment bundle: You continue to pay your loan in a decade, however your costs start lower while increasing all the 2 years.

This is greater than the interest rates on the other types of federal figuratively speaking, and therefore already vary from 5

- Lengthened cost package: You have to pay a fixed or graduated number for approximately twenty-five years. This process will cost you much more overall.

This installment loan Delta really is higher than the eye prices with the other sorts of federal student education loans, and this already start from 5

- Income-contingent cost (ICR) plan: You ought to combine the Head Together with financing to become qualified to receive ICR. Your own payment per month will be the lesser out-of 20% of your discretionary earnings — the essential difference between your income together with impoverishment tip to suit your county and relatives size — or perhaps the matter you would shell out towards the a fixed a dozen-year payment package. Repayments was recalculated each year centered on earnings and you can family proportions.

When you have difficulties checking up on your payments, you happen to be in a position to consult forbearance — a temporary halt on the costs — while your son or daughter is actually college and 6 months pursuing the graduation. This will be only for fool around with when you are experiencing brief difficulty.

This might be higher than the interest rates to your other types of government figuratively speaking, and that already are normally taken for 5

- work with good nonprofit or other being qualified business having ten years,

- create 120 to your-time costs, and

- fill in appropriate documentation on a yearly basis.

3rd, you could seek out a pops education loan having a personal lender. This type of financing try less common than personal college loans, so you may should do some research to find lenders that provide it.

In lieu of government loans, also provides of personal lenders will disagree and are very different according to the earnings and you may a career records, credit rating, and you will loans-to-money (DTI) ratio. DTI is actually a measure of your own monthly expense compared to the your monthly money. Essentially, your own month-to-month financial obligation repayments cannot go beyond 35% of one’s month-to-month income. Whenever they manage, loan providers was reluctant to help you.

People with a credit history from 700 otherwise above commonly meet the requirements for the best cost. That’ll create a personal mother or father education loan more affordable than a father Direct As well as mortgage.

Keep an eye on the rate you get. Individual lenders may offer repaired figuratively speaking — the spot where the interest remains the exact same across the lifetime of the mortgage — or variable student education loans. Adjustable figuratively speaking usually start with less interest, nonetheless they normally increase throughout the years. Once they do, your instalments increases and also you you will definitely spend a whole lot more complete.

Some individual education loan enterprises give you a choice of fees preparations or promote deferment otherwise forbearance, but this can be around the financial institution. For people who concern your ability to blow back your college loans, you might be prone to default. You’re best off adhering to a daddy Head Together with financing so that your cost conditions be much more flexible.

Leave a Comment