At the GRB, i make the process of getting a mortgage loan or re-finance as facile as it is possible. All of us out-of knowledgeable home loan lenders from inside the West and you may Central Nyc will meet to you to discuss the money choices. There are many lending options therefore we aid you to dictate the loan financing that is true for the state. And if you are prepared to buy, you will have the fresh pre-qualification you’ll want to setup a robust promote. You get timely approvals, as well, given that credit choices are available in your town.

Find out more on all of our financing circumstances, financial downline and make use of all of our on the internet hand calculators first off the fresh process to home ownership!

- We

- Money

- Real estate loan Calculator

- Home mortgage refinance loan Calculator

- Call us to get going

Online Application and you may Real estate loan Loan calculator

You can expect appointment calls or video clips chats with these GRB financial cluster, including a straightforward on the web real estate loan software.

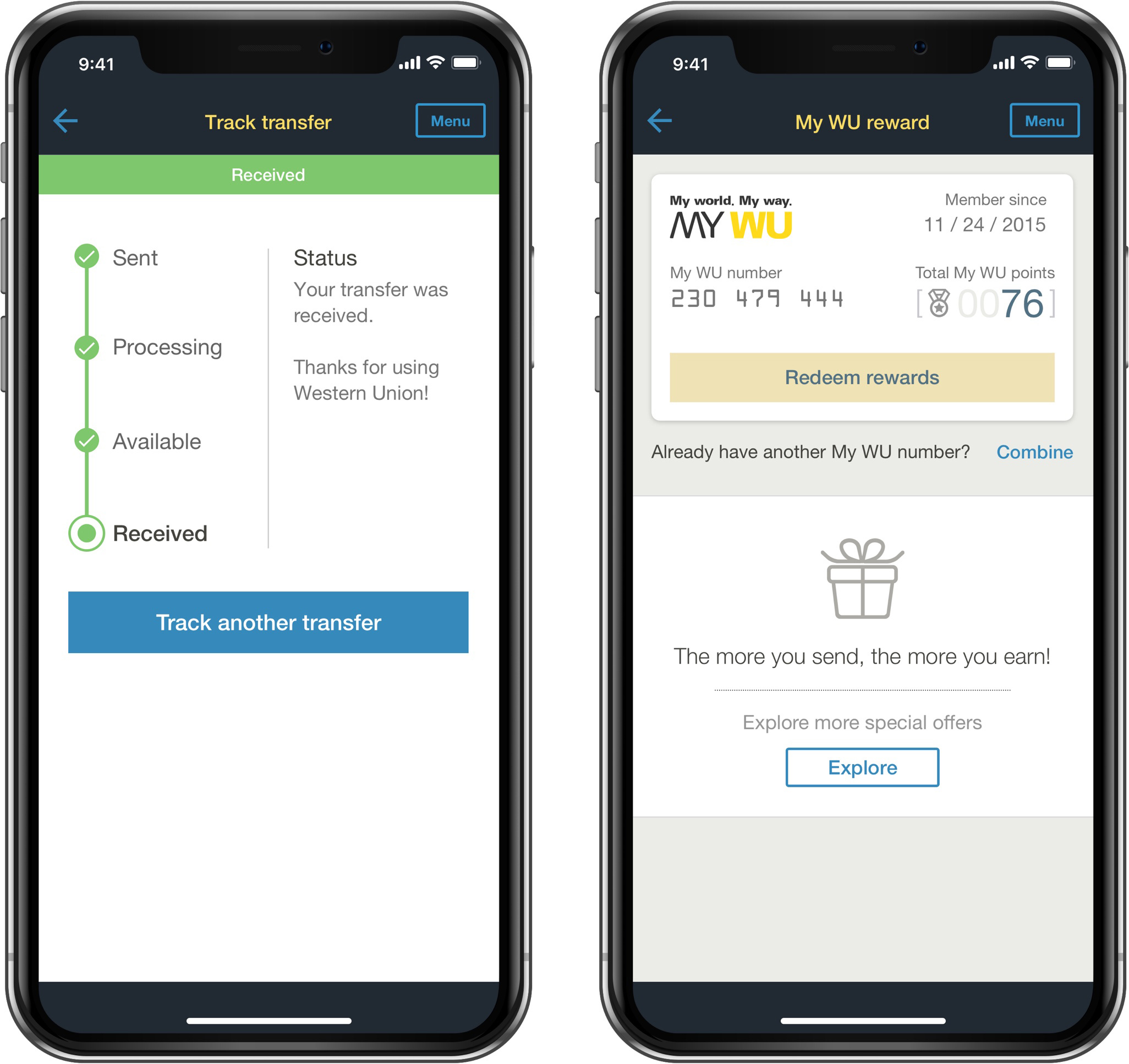

The latest GRB Home loan Show cellular app makes it easy and you will much easier to put on and you may take control of your loan. You need to use the mortgage calculator to evaluate commission information in the real time. Make use of the app so you’re able to upload records using your mobile device’s cam, and you will sign off for the paperwork using age-signature.

GRB try a nationally inserted financial lender, to ensure that is stays local and use our very own online software and you can mobile software regardless of if purchasing a second house of county.

Prequalification otherwise Preapproval?

You have heard the news headlines, the actual home industry when you look at the New york county was hot. Prospective buyers usually see by themselves to make multiple now offers up to you’re in fact accepted. To raise your chances of providing an accepted give, consider protecting a mortgage preapproval in the place of an excellent prequalification.

Prequalification Good prequalification was an initial step up the loan processes where a lender prices how much cash you’re able to use according to guidance you provide regarding your money, assets, bills, and you can credit rating. Typically, prequalification pertains to a simple comparison of the financial situation, usually over informally and you may without a thorough report on their borrowing report. Prequalification will give you a crude idea of how much cash you could potentially be able to obtain, however it is maybe not a guarantee. The true amount borrowed and you can terms and conditions can differ immediately following a far more comprehensive report on your bank account and you may credit score.

Preapproval A beneficial preapproval was a far more certified process in which a lender carefully assesses your financial history, plus earnings, assets, expense, and you can credit rating, to determine exactly how much they are prepared to give you. Getting a great preapproval pertains to entry documents such as for instance shell out stubs, W-2 versions, lender statements, and you may agree into financial to pull your credit history. The lending company up coming verifies what offered and you will analyzes your creditworthiness. A beneficial preapproval is a healthier indication of your credit energy compared to help you prequalification. While it’s perhaps not a promise away from financing, it deal more excess weight that have suppliers because it relates to a thorough breakdown of your bank account by lender.

To put it briefly, prequalification is a primary comparison predicated on information you give, if you find yourself preapproval comes to a very tight review of your cash, including papers and you may credit score. Preapproval are experienced far more reliable and helps create a stronger promote inside a property purchases.

Building More powerful Communities Providing West and loan for bad credit 5000 you will Main New york

GRB has many mortgage financial loans and: first-time homebuyers; down-payment direction; grants; antique fund; FHA, Va and you can USDA bodies fund; and you will numerous special software designed to turn your house purchasing fantasies on a reality.

Here are some Our very own Most other Functions

GRB also offers a collection economic qualities to simply help your business develop, assistance your day-to-day banking means, that assist you buy otherwise re-finance your property.

Private Financial

Within GRB, personal financial is actually personal. We provide various financial circumstances to support every one of your financial needs, and fits them up with a single services feel tailored so you’re able to make your economic future.

Commercial Financial

At the GRB, we understand you to bringing your business one stage further requires an incredible period of time, faith, therefore the right partnerships. Our industrial banking people also provides all that thereby far so much more. That have brief, locally produced approvals, we’re going to place you into quick track to meet your organization goals.

Leave a Comment