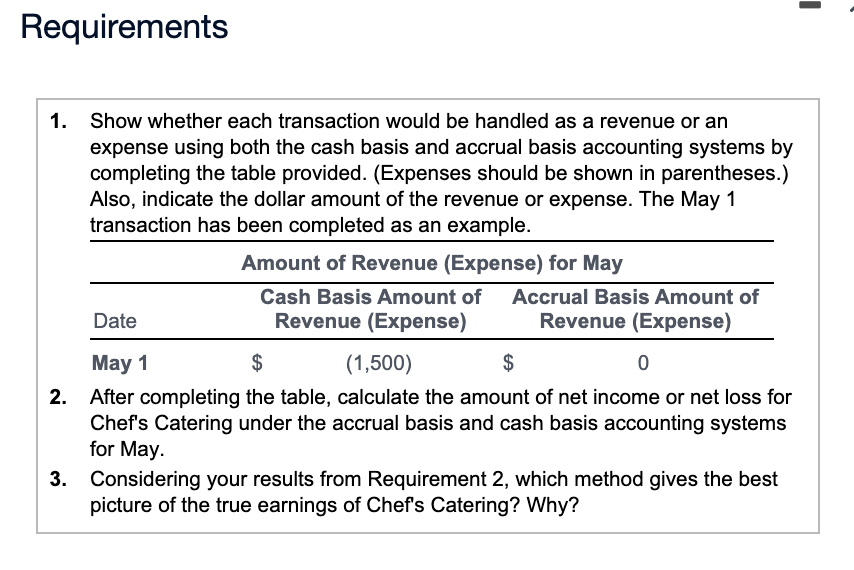

So you can offer Housing for everybody and to allow home buyers buying domiciles within reasonable-prices funds, the us government away from Asia brings some income tax gurus into focus into casing funds paid off because of the consumer. The new below dining table summarises the newest income tax advantages which can be browsed from the borrower in arrangements of income tax Act, 1961 (the fresh Act’):

The majority of the customers know the deduction readily available around Area 80C and you can 24(b) of the Work. not, they’re not alert to the excess deduction of interest hence exists under Point 80EE and 80EEA of your Operate. Let us understand the additional taxation work with open to the consumer under Section 80EE and you will 80EEA of the Act.

Area 80EE: Focus into the mortgage taken to own residential house assets:

So you’re able to incentivize brand new reasonable housing sector underneath the objective from Casing for everybody, the us government away from India brings even more deductions towards home loan desire getting earliest-day homebuyers not as much as installment loans for bad credit Long Beach Point 80EE of the Act. tThis deduction was allowed to individual consumers so you can allege a lot more write-offs not in the of them available around Section 24(b). The main benefit less than so it Area is restricted to housing loans approved between the monetary seasons 2016-17 i.age. out of . One financing sanctioned beyond FY 2016-17 are not qualified to receive work with around it Area.

Trick options that come with Part 80EE of Act:

Eligible Person : The bonus lower than Section 80EE of your own Work is present so you can private very first-day homebuyers. This means that personal claiming deduction lower than Area 80EE of the newest Operate should not own one home-based family assets towards the big date out of sanction from mortgage.

Type of mortgage protected : The advantage around Area 80EE can be acquired to own desire paid back to the houses financing i.age. the loan would be removed simply for the purchase out-of home-based household assets. Interest taken care of financing taken with the aim besides buy out-of domestic home home is maybe not protected into the ambit of this Section.

Time away from approve : The fresh houses loan approved from the a lender when you look at the months delivery on 1 st day’s is approved because of it point. One loan sanctioned ahead of isnt secured within the ambit of this section.

Organization eligible for sanctioning housing mortgage : The borrowed funds is going to be sanctioned of the lender. The economic institution’ function banking providers, or one lender otherwise banking business otherwise a homes monetary institution.

Restriction deduction tolerance : Maximum deduction interesting to the property loans invited less than that it point having a particular monetary season try Rs. 50,000.So it deduction is during introduction towards the deductions readily available not as much as Area 24(b) for financial interest. The benefit of Area 24(b) of one’s Work might be availed basic and you will thereafter, advantageous asset of Section 80EE and you can Part 80EEA of your own Operate will be end up being availed. However if deduction less than Point 80EE and you may Section 80EEA of the Work is said first unlike Section24(b), following such case attention reduced into homes financing should maybe not be eligible for deduction below Area 24(b) of the Work.

Deduction months : The other deduction of great interest to your construction loan can be found getting new financial year beginning from twenty four hours out of and after that many years, susceptible to aforementioned conditions.

Interesting issues of Area 80EE:

Old versus brand new home : The root residential family assets are gotten will likely be established otherwise the brand new. There is absolutely no segregation / mandate to find present otherwise new house property. The only reputation is the fact purchase of residential domestic assets will be happen.

Co-possession : In case the home is owned as you, both co-owners meet the criteria to help you allege a good deduction under Point 80EE when the it fulfil the brand new eligibility standards.

Leave a Comment