Winnings with difficult profit that it in love market

In the present super aggressive e method as you can use cash. Money is queen in the world of a home!

New providers which deal with dollars offers require an instant and you may simple marketing of its possessions plus don’t need to waiting for the slow fund of their people to pay for. By simply making bucks now offers having fun with difficult money, it can help the probability of taking an offer accepted towards property pick.

A challenging money financing is like an enthusiastic all the bucks bring toward seller by the rate of capital. You could romantic a challenging money mortgage when you look at the as fast as a day in some cases.

As to the reasons hard cash is same as a profit give for the house

When purchasing a home, and then make a virtually all bucks provide could possibly be the the answer to bringing good home price lower than bargain. But if you do not have every cash, how can you fool around with a hard money loan particularly bucks?

Tough money finance are asset-built money. It indicates they may not be acknowledged predicated on your very own borrowing get but rather according to the possessions which is used to secure the mortgage. As soon as approved, an arduous money loan can be typically funds in under a great week, identical to bucks. For that reason a challenging currency loan serves just like, or very similar to, a nearly all bucks bring

Simple tips to Establish a cash Render Playing with Difficult Currency

3. Submit the promote to find and you may write on the offer, cash and difficult money. There isn’t any resource otherwise appraisal deadline. The newest payment time could be just after the newest homework deadline closes. Highly recommend a subject or https://paydayloancolorado.net/sugar-city/ escrow company as your settlement representative toward new bargain.

What Realtors Should be aware of Composing a deal Using Hard Currency Loans

Step 2: When composing within the render, according to the point one to listing the manner in which you propose to buy buy. Write in the amount of the new serious money put.

Step 3: After that develop, N/A close to Brand new Mortgage. Next generate the language dollars and hard money alongside where they listing the bill due from inside the bucks in the payment once you deduct the degree of the serious money put.

3: From the funding and you can appraisal standing areas of the latest package, guarantee that it says that purchase of the property are Not contingent with the investment approval, and it is Perhaps not contingent into the an appraisal. Most difficult money lenders have a tendency to pre accept you having a buy and most do not require an appraisal. Make sure your difficult money lender does not require an assessment. Whether your lender do require an assessment, they don’t will be just like cash. Because it takes lengthier to track down an appraisal, it won’t be capable satisfy the price away from a finances pick if there’s an assessment demands.

Paying back the borrowed funds

A hard money-lender offers a particular mortgage name, which is the time there are the borrowed funds up to they is going to be reduced. Particularly, a great 6 times label, good several month term, otherwise an excellent 24 month title. You’ll build monthly premiums into the hard money-lender to have the size of the mortgage label, or till the day unless you afford the mortgage right back.

You have to pay desire since you go, you simply are obligated to pay appeal to the go out there is the financing. Instance when you yourself have a loan title from 12 months nevertheless afford the loan away from from inside the nine weeks, you only pay appeal getting 9 weeks towards time your have the mortgage. Most loan providers do not have very early pay charges but always inquire when there is a punishment if you spend the money for financing regarding until the deadline. Find out about ext arrangements here.

What are the Settlement costs and you can Rates of interest?

A borrower can expect to blow settlement costs out-of ranging from 2-3% of amount borrowed typically. And part of an effective borrower’s closing costs is a loan origination fee or mortgage points. The eye rates towards the a painful currency loan constantly trust how big is new deposit towards a purchase and you can range from 9% to a dozen%.

Achievement

The difficult money mortgage is an earnings provide on the a home. You don’t have to value credit score, long wait minutes having capital, or other conventional mortgage conditions you to finance companies generally wanted.

It’s easy the real deal auctions and manufacturers to get going that have a difficult currency financing compliment of all of us from gurus a good Private Money Utah!

When you find yourself happy to pick today but cannot wait weeks otherwise weeks when you’re waiting to your a lender approval, call us today and let’s obtain the procedure already been together!

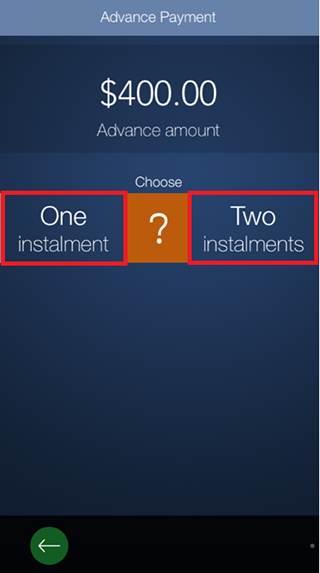

Why don’t we talk more info on the way we may help you pay off so it short closing fund as quickly as month by providing a keen reasonable payment alternative.

Leave a Comment